Introduction

Navigating the world of real estate can seem complex, but understanding the fundamental legal framework in India for buying, selling, renting, or mortgaging property is key. The Transfer of Property Act, 1882, serves as a cornerstone, aiming to simplify the intricacies of property transactions for everyone involved. This blog will explore the core aspects of property transfer, the various ways it can occur, and crucial principles to keep in mind.

What Does “Property Transfer” Really Mean?

At its heart, “property transfer” refers to the process of legally shifting the ownership or title of an asset from one individual or entity to another. In India, this is primarily governed by the Transfer of Property Act, 1882, which came into effect on July 1, 1882. This comprehensive law outlines the conditions and procedures for such transfers, ensuring clarity and legality in all transactions.

For the purpose of this Act, property broadly falls into two categories:

- Immovable Property: This includes land, houses, and any structures permanently attached to the land. Think of a residential building or a plot of agricultural land.

- Movable Property: This encompasses assets that can be easily moved, such as jewelry, fixed deposits, bank accounts, and cash.

Under the 1882 Act, a “transfer of property” signifies an action where a person conveys ownership of an asset to one or more individuals, or even to themselves, either immediately or at a future date. It’s about legally bestowing rights and responsibilities associated with the property.

Common Methods of Property Transfer

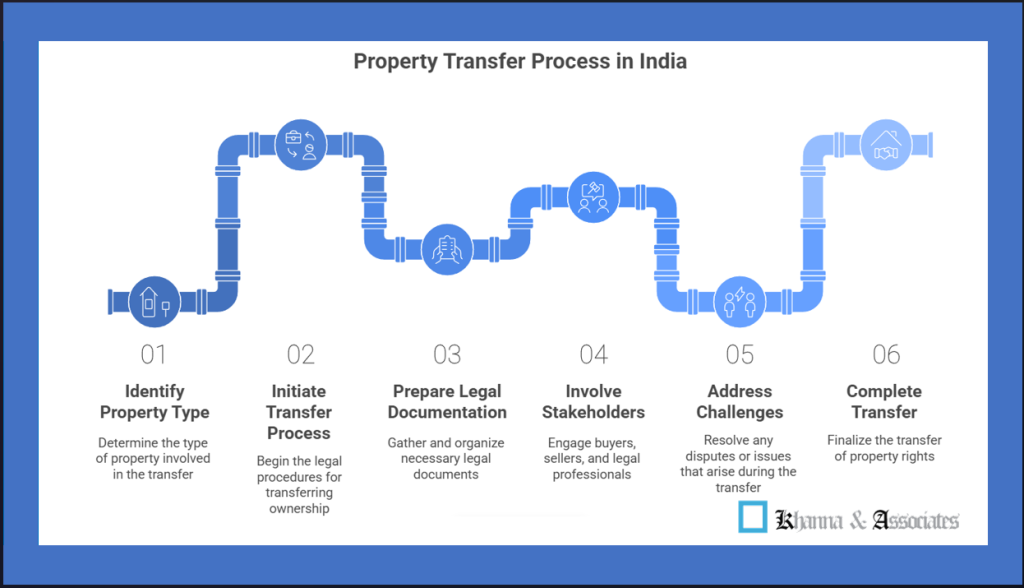

While the concept of transfer is straightforward, the actual methods can vary. Here’s a look at the most common ways property ownership changes hands:

- Sale Deed: This is arguably the most prevalent method. A Sale Deed involves two parties: a seller and a buyer. Ownership is transferred in exchange for a monetary consideration (the sale price). The transfer is finalized once the deed is officially registered at the Sub-Registrar of Assurances office. This registration is a crucial step to make the transfer legally valid and public. For more information on property registration, you can refer to the National Generic Document Registration System (NGDRS) portal, a project by the Department of Land Resources, Ministry of Rural Development .

- Gift Deed: As the name suggests, a Gift Deed facilitates the transfer of property ownership as a gift. This transfer must be voluntary, free from any undue influence. A key requirement is that the recipient must accept the gift while the donor is still alive. If acceptance doesn’t occur during the donor’s lifetime, the gift becomes null and void, as stipulated in Section 122 of the Transfer of Property Act, 1882.

Transactions That Don’t Qualify as Full Transfers

Not every interaction involving property amounts to a complete transfer of ownership. Understanding these distinctions is vital:

- Relinquishment Deed: In a Relinquishment Deed, an owner gives up their share or rights in a property in favor of another co-owner, typically without any monetary exchange. This is commonly seen in family property disputes or settlements. It’s important to note that this deed only transfers rights among existing co-owners; it doesn’t convey title to a third party. Stamp duty is applicable only on the relinquished share, not the entire property.

- Will: A Will is a legal document that dictates how a person’s property will be distributed after their demise. Unlike other transfer methods, a Will takes effect only upon the death of the person making the Will (the testator). It doesn’t require the presence of a “juristic person” (a living legal entity) at the time of its creation. After the testator’s death, legal heirs typically apply to the relevant authorities with a copy of the death certificate, the Will, and a succession certificate to complete the allocation process.

- Partition Deed: When properties are jointly owned, a Partition Deed is used to divide the property among the co-owners, clearly defining each person’s share. While it redefines individual ownership within a shared property, it’s not considered a “transfer” in the sense of bringing in a new owner, but rather a division among existing ones.

- Lease or Leave and Licence Agreement: These agreements grant temporary possession of a property to another person (the lessee or licensee) for a specific period, usually in exchange for rent or a license fee. However, they do not transfer the actual ownership or title of the property. Once the lease or license period expires, possession reverts to the original owner. A key difference from a lease is that a Leave and Licence Agreement typically grants a personal right to occupy, which is non-transferable and often more easily revocable by the owner.

Key Principles Governing Property Transfer

Several fundamental principles underpin the lawful transfer of property in India:

- Transfer to a Living or Juristic Person: For a valid transfer to occur, it must be between living individuals or “juristic persons.” This can include individuals, companies, or associations. Partnerships, however, are generally not considered juristic persons for this purpose.

- Present or Future Conveyance: Property can be transferred immediately in the present or with a stipulation for future effect.

- Transferability of Property: Not all properties can be transferred. Section 6 of the Transfer of Property Act, 1882, specifically lists certain types of properties that are non-transferable. For instance, a mere right to sue or a public office cannot be transferred.

- Competence of the Transferor: The individual transferring the property must be legally competent to do so. This means they must be of sound mind, have attained the age of majority (18 years in India), and not be disqualified from entering into a contract by any law. This aligns with Section 11 of the Indian Contract Act, 1872, which outlines the conditions for contractual capacity.

- Prescribed Form of Transfer: For intangible properties or certain types of transfers, specific written formats and payment of government fees are often mandated. This ensures proper documentation and legal validity.

- Rule Against Perpetuity: This principle states that property interests cannot be tied up indefinitely into the future. Generally, a property must be transferred during the lifetime of an identifiable individual. While a property can be transferred for the benefit of an unborn child, strict conditions apply, ensuring the interest vests within a certain timeframe and the ultimate beneficiary is a living person upon reaching majority.

- Conditional Transfer: Section 25 of the Transfer of Property Act, 1882, allows for conditional transfers of property. However, if the condition attached to the transfer becomes impossible to fulfill, is forbidden by law, or goes against public policy, then the transfer itself may be considered void.

FAQs

Q1: Is it mandatory to register all property transfers?

While not every single form of property change requires compulsory registration (like a Will, which takes effect post-demise), for transactions like sales, gifts of immovable property, and leases for terms exceeding one year, registration is legally mandated under the Registration Act, 1908. This provides legal sanctity, acts as public notice, and helps prevent disputes.

Q2: What is the role of stamp duty and registration fees?

Stamp duty is a tax levied by the state government on property transactions, while registration fees are charged for recording the transaction with the Sub-Registrar’s office. Both are crucial for making a property transfer legally valid and enforceable in a court of law. The rates vary by state and the type of transaction.

Q3: Can a minor transfer property in India?

No. According to the Indian Contract Act, 1872, a minor (someone under 18 years of age) is not competent to enter into a contract. Therefore, a transfer of property by a minor is typically void or voidable. However, a property can be acquired by a minor through a guardian or natural parent.

Q4: What is a “juristic person” in the context of property transfer?

A juristic person, also known as a legal person, is an entity (like a company, a cooperative society, or an idol) that is treated as having legal rights and duties, much like a natural person, even though it is not a human being. This allows them to own property, enter into contracts, and sue or be sued.

Q5: What happens if a property transfer is not done as per the law?

If a property transfer doesn’t adhere to the applicable laws and regulations (e.g., proper documentation, registration, or fulfilling conditions), it can lead to the transfer being legally invalid, unenforceable, or challenged in court. This could result in disputes, loss of ownership rights, and financial implications.

Conclusion

From the common sale deed to specific scenarios like relinquishment or partition, each method of property interaction has its own set of rules and implications. By being aware of the core concepts, the various modes of transfer, and the fundamental principles guiding them, individuals can navigate property transactions with greater confidence and ensure their legal rights and interests are protected. Always consider seeking professional legal advice for specific property matters to ensure full compliance and avoid potential pitfalls.