Introduction

Establishing a business in India has become remarkably simpler, thanks to the government’s forward-thinking initiatives, particularly the introduction of the unified online application system, SPICe+, on the Ministry of Corporate Affairs (MCA) portal. What was once considered a complex and time-consuming process has been significantly streamlined, reflecting substantial improvements in legal frameworks and registration procedures.

This article aims to provide a clear and comprehensive overview of the online company registration process in India, along with essential legal compliances you should be aware of. We understand that navigating these changes can be challenging, and our goal is to offer clarity every step of the way.

Understanding Business Structures in India

Before embarking on the registration journey, it’s crucial to identify the most suitable legal structure for your business. Each type comes with its own set of rules and implications. Here are the primary business structures recognized in India:

- Limited Liability Partnership (LLP): An LLP offers the benefits of a partnership (flexibility) combined with limited liability for its partners. This means the partners’ personal assets are generally protected from the business’s debts, and liability is limited to their capital contribution.

- Private Limited Company (Pvt. Ltd. Co.): This is a popular choice for many businesses, particularly startups. A Private Limited Company is a distinct legal entity, separate from its founders, directors, and shareholders. This separation offers limited liability protection to its members, meaning their personal assets are not typically at risk for the company’s debts. All individuals working for the company are considered its “employees.”

- One Person Company (OPC): Introduced in 2013, the OPC allows a single individual to incorporate a company with limited liability. This structure is ideal for sole entrepreneurs who wish to operate with a corporate identity while retaining full control.

- Public Limited Company (Public Ltd. Co.): Unlike a Private Limited Company, a Public Limited Company can offer its shares to the general public. The liability of its shareholders is limited to the value of shares they hold, protecting them from losses exceeding their investment.

Why Choosing the Right Business Structure Matters

The choice of business structure profoundly impacts various aspects of your operations. An informed decision is vital, as an unsuitable structure can lead to financial repercussions for both the individuals involved and the business itself. Key considerations include:

- Audit Requirements: Registered businesses often have specific auditing requirements to ensure financial transparency and legal compliance. Selecting the right structure will dictate the complexity and frequency of these audits.

- Income Tax Implications: The tax burden varies significantly across different business structures. For instance, a sole proprietor’s business income is typically taxed as their personal income, while a company (as a separate entity) must file its own corporate income tax returns. Understanding these differences is crucial for effective tax planning.

- Business Expansion Potential: Different structures offer varying degrees of flexibility and ease when it comes to business expansion, raising capital, or bringing in new partners. It’s important to consider your long-term growth aspirations when making this initial choice.

Essential Documents for Company Registration in India

The government’s SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) online portal has significantly expedited company registration. This integrated system allows for simultaneous application for company name reservation, Director Identification Number (DIN), and Permanent Account Number (PAN) along with the incorporation process.

Here’s a general list of mandatory documents required for company registration in India:

- Identity Proof:

- Permanent Account Number (PAN) (mandatory for all Indian directors/subscribers).

- At least one of the following: Aadhaar Card, Passport, Driving License, or Voter ID Card.

- Address Proof:

- Telephone or Mobile Bill.

- Electricity or Water Bill.

- Copy of Bank Passbook (with latest transaction entry) or Bank Statement (not more than 2 months old).

- Passport-Size Photographs: Typically three per individual.

Important Notes:

- All documents must be self-attested by the individuals involved.

- It’s always advisable to submit the most recent bills and documents; for example, utility bills should not be older than two months.

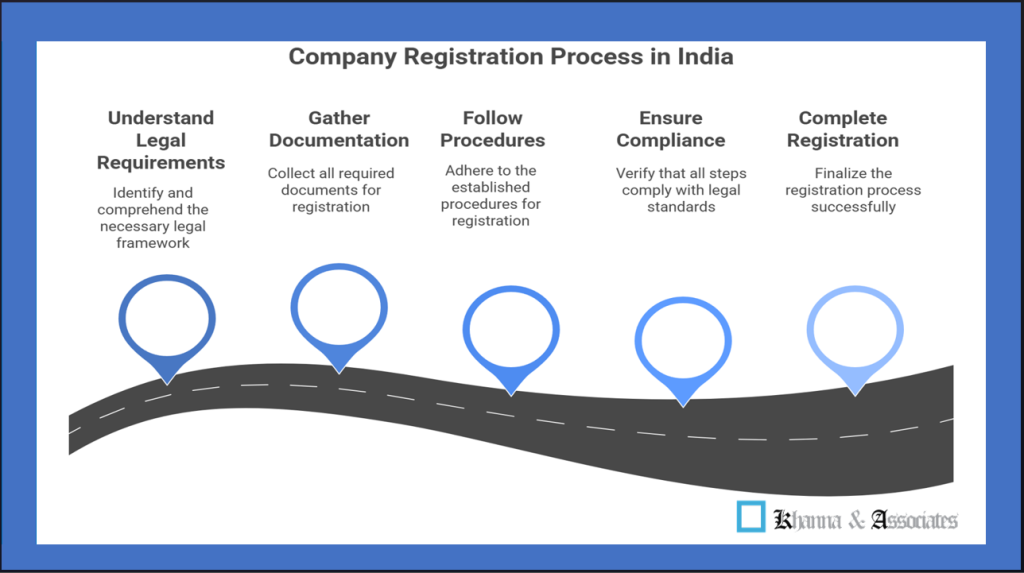

The Online Company Registration Process: Key Steps

The entire company registration process has transitioned online, primarily through the MCA portal . Here are the crucial elements you need to understand:

- Director Identification Number (DIN): This is a unique identification number issued to individuals who intend to be directors in any company. It’s a fundamental requirement for anyone taking on a directorial role.

- Digital Signature Certificate (DSC): As the entire process is online, directors and authorized signatories of the company need to obtain a Digital Signature Certificate. This digital equivalent of a physical signature is essential for electronically signing various forms submitted on the MCA portal.

- Registration on the Ministry of Corporate Affairs (MCA) Portal: The initial step involves registering as a user on the MCA website. This grants access to various online services, including filing forms and accessing public documents. The core of the registration is the submission of the SPICe+ form along with all supporting documents.

- Certificate of Incorporation: Once all required documents are submitted and reviewed by the Registrar of Companies (ROC), and the application is approved, the ROC issues a “Certificate of Incorporation.” This certificate officially brings your company into existence.

Advantages of Registering Your Company in India

Registering your company in India offers a multitude of benefits that extend beyond mere legal compliance, significantly impacting the business’s future and its stakeholders. Some key advantages include:

- Separate Legal Entity: Under the Companies Act, 2013, a registered company attains a distinct legal identity. This separation means the company can own assets, incur debts, and engage in legal proceedings independently. The personal liability of individual members is limited, protecting their private assets from business obligations.

- Perpetual Succession: A registered company enjoys “perpetual succession,” meaning its existence is continuous and unaffected by changes in directors, shareholders, or other members. As long as it complies with the Companies Act, the company remains active.

- Transferability of Shares: For companies with share capital, registration facilitates the easy transfer of shares among promoters and stakeholders, providing liquidity and flexibility for ownership changes.

- Enhanced Credibility and Funding Access: A registered company projects professionalism and trustworthiness. This often makes it easier to secure loans from banks, attract investments from venture capitalists, and build stronger relationships with suppliers and clients. Many government schemes and incentives are also exclusively available to registered entities.

- Intellectual Property Protection: Registering your company name and potentially trademarks provides legal protection against unauthorized use by others, safeguarding your brand identity.

Choosing and Registering Your Company Name

Selecting the right name is crucial, as it becomes your brand’s public identity. While the registration process has simplified, certain rules apply to company names:

- The name must not be identical or too similar to any existing LLP, company, or registered trademark.

- The name’s structure must comply with legal guidelines (e.g., typically including an activity word).

- Generic names, or those related to common geographical areas, are generally not permitted.

- The chosen name should not contain offensive words or infringe upon existing trademarks or emblems.

To register your company name, you (or someone on behalf of your company) must use the SPICe+ Part A service on the MCA portal to check availability and reserve your proposed name.

How to Register a Private Limited Company in India: Step-by-Step Guide

This is one of the most common and recommended structures for many new businesses:

- Obtain Digital Signature Certificate (DSC): Required for all proposed directors and subscribers.

- Apply for Director Identification Number (DIN): Can often be applied for concurrently with the SPICe+ form.

- Reserve Company Name: Use SPICe+ Part A on the MCA portal.

- Prepare and Submit E-MOA (Memorandum of Association) and E-AOA (Articles of Association): These crucial documents define the company’s objectives and internal rules.

- File SPICe+ Part B: This is the main application form for incorporation, combining applications for DIN, PAN (Permanent Account Number), and TAN (Tax Deduction and Collection Account Number).

- Receive Certificate of Incorporation: Issued by the Registrar of Companies upon approval.

- Open a Current Bank Account: Essential for business transactions in the company’s name.

Simplified Registration for Specific Business Types

- How to Register a Proprietorship Firm in India: Sole proprietorships are among the simplest business structures to establish. While there isn’t a central “registration” in the same way as companies, you typically need to:

- Have an Aadhaar Card and PAN card.

- Open a bank account in the business’s name.

- Obtain necessary local licenses and registrations like GST registration (if turnover exceeds threshold) , Shop and Establishment License, and MSME (Micro, Small and Medium Enterprises) Registration / Udyam Registration [Link to Udyam Registration Portal: [suspicious link removed]].

- If engaging in import/export, an Import-Export Code (IEC Code) is required.

- How to Register a Startup Company in India: India offers significant support for startups through the “Startup India” initiative. The process generally involves:

- Obtaining your company’s Incorporation/Registration Certificate (as a Private Limited Company, LLP, etc.).

- Having details of all directors.

- Providing a “Proof of Concept” if your startup is in the validation, early traction, or scaling stage.

- Registering with the “Startup India” portal.

- Receiving DPIIT (Department for Promotion of Industry and Internal Trade) Recognition, which unlocks various benefits.

- Ensuring you have a PAN Number for the company.

- Considering patent and trademark details for intellectual property protection.

FAQs

Q1: What is SPICe+ and why is it important?

SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) is an integrated web form introduced by the Ministry of Corporate Affairs (MCA). It’s crucial because it combines multiple services into a single application, allowing you to reserve a company name, apply for DIN, PAN, TAN, and incorporate your company all at once, significantly simplifying and speeding up the registration process.

Q2: Is a physical office address mandatory for company registration?

Yes, it is mandatory for a company to have a registered office in India from the date of its incorporation. This office must be publicly accessible for correspondence and notices. You need to provide proof of this address during the registration process.

Q3: Can a foreign national be a director in an Indian company?

Yes, foreign nationals can be directors in Indian companies. However, for a Private Limited Company or Public Limited Company, at least one director must be a “resident in India,” meaning they have stayed in India for a minimum of 182 days in the preceding financial year.

Q4: What is the difference between MOA and AOA?

The Memorandum of Association (MOA) is a fundamental legal document that defines the company’s constitution, its main objectives, its scope of activities, and its relationship with the outside world. The Articles of Association (AOA) are internal documents that lay down the rules and regulations for the internal management of the company, governing how its operations are conducted and defining the rights and duties of its members and directors.

Q5: What are the consequences of not registering a business in India?

Operating an unregistered business can lead to severe legal and financial repercussions. These can include penalties, fines, inability to enter into formal contracts, difficulty in raising capital, lack of legal protection for your brand and assets, and potential personal liability for business debts. It’s crucial to comply with all registration requirements to avoid such risks.

Q6: Where can I find the latest updates on company law in India?

The Ministry of Corporate Affairs (MCA) website is the primary source for all official updates, circulars, and notifications related to company law in India. You can also refer to the Companies Act, 2013, and its subsequent amendments.

Conclusion

Adhering to the legally defined process for company registration in India is not just a regulatory obligation but a foundational step towards building a successful and sustainable enterprise. Failure to comply can result in severe penalties, including legal action against the company and its stakeholders, or even the cancellation of the company’s license.