Introduction

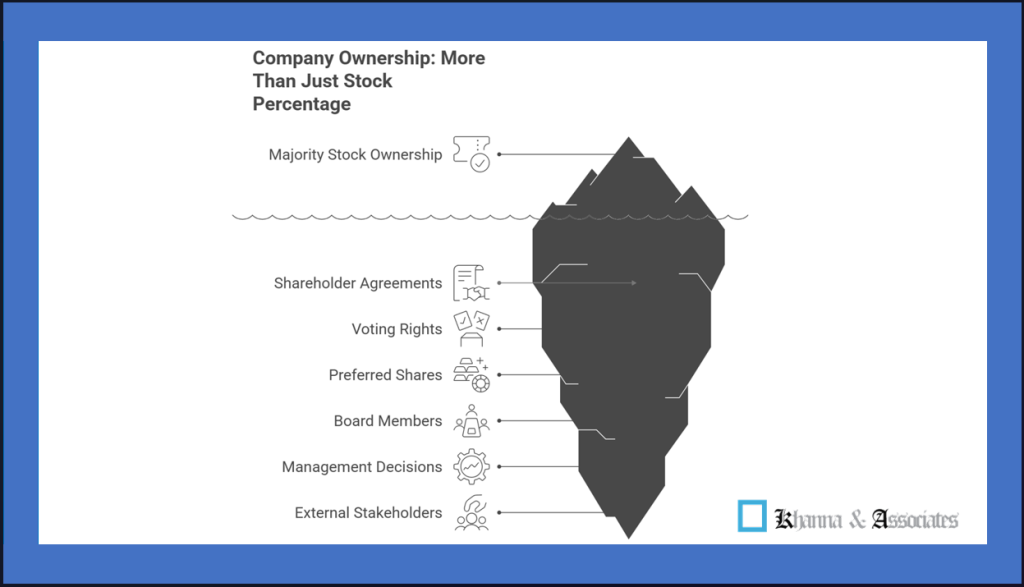

In the corporate world, the term “company ownership” can sometimes be a bit nuanced. While simply holding shares in a company certainly makes you an owner in a broad sense, your actual influence and decision-making power are intrinsically tied to the proportion of shares you possess. Effective businesses thrive on clear leadership and a well-defined understanding of roles. When it comes to steering the ship and making significant strategic choices, it’s typically the owners who call the shots, with the rest of the organization following their directives.

Defining a Company Owner

At its heart, a company owner is an individual or group that holds the reins, overseeing the operations and financial health of a business. Whether you choose to embark on this journey solo or as part of a collective, owners ultimately bear the authority and responsibility for shaping the company’s direction, setting strategies, and guiding the team.

It’s important to understand that becoming a company owner doesn’t always mean you were the one who started it from scratch. You can acquire ownership in an existing company through various means:

- Holding 51% or more of the company’s shares: This percentage typically grants you controlling authority, meaning you have the final say in major business decisions.

- Owning less than 50% of the company’s shares: Even a small stake, like 1%, makes you an owner. However, in such scenarios, the power to make critical decisions is shared among all significant shareholders or “stakeholders.” This often involves a collaborative approach where collective agreement is crucial.

Pathways to Owning an Existing Company

Beyond starting a venture from the ground up, one common way to gain company ownership, especially controlling interest, is through strategic acquisition. This involves a structured process of taking over another business. Here’s a deeper look into the steps involved:

1. Crafting Your Acquisition Strategy

The initial phase is about setting a clear objective: what do you hope to achieve by acquiring another business? Acquisitions generally fall into two main categories:

- Horizontal Acquisition: This is when your company acquires a direct competitor. The goal is often to consolidate market share, reduce competition, and achieve economies of scale.

- Vertical Acquisition: Here, a company acquires another entity within its supply chain, either a supplier (backward integration) or a distributor (forward integration). This aims to enhance efficiency, reduce costs, and gain more control over the production or distribution process.

Key benefits of such acquisitions can include boosting your company’s overall value, potentially a lower entry cost compared to starting a new venture in that market, and the principle that a combined group of companies often holds more value than the sum of its individual parts. It’s also vital to consider whether the acquisition is primarily for industrial expansion (gaining operational assets) or financial investment (seeking a return on capital).

2. Pinpointing Your Purpose for the Search

Before you even start looking, define the core reason behind your desire to acquire. This clarity will guide your search and help you identify companies that truly fit your needs. Common motivations include:

- Revamping Management: You might identify a company with promising potential but a need for stronger leadership, believing you possess the right expertise to turn it around.

- Expanding Geographical Reach: Acquiring a company with an established presence in new regions can be a fast-track to market expansion.

- Financial Injection (Treasury): If a company is in need of capital, you could provide funding in exchange for an equity stake, offering a mutually beneficial arrangement.

- Complementary Business Areas: Seeking a company whose operations complement your existing business can lead to synergistic growth and broader service offerings.

- International Expansion: Acquiring a foreign entity can be a strategic move to establish a global footprint. For guidance on foreign investments in India, you can refer to the Department for Promotion of Industry and Internal Trade (DPIIT).

- Eliminating Competition: A direct acquisition of a rival can consolidate your market position. The Competition Commission of India (CCI) oversees mergers and acquisitions to prevent anti-competitive practices.

3. Searching for Potential Acquisition Targets

Identifying the right company is crucial. This involves understanding their current state and assessing how their strengths could benefit your existing operations. You might:

- Engage Professional Advisors: Experienced mergers and acquisitions (M&A) consultants or investment bankers can help scout for suitable targets.

- Leverage Financial Institutions: Your bank or other financial partners might have insights into businesses looking for acquisition or investment.

4. Strategizing the Acquisition Approach

Once you’ve identified potential targets, the next step is to initiate contact to gather more information and gauge their openness to an acquisition. This phase often involves:

- Non-Disclosure Agreements (NDAs): Companies typically sign NDAs to protect sensitive information when discussing potential deals.

5. Evaluating the Target Company Thoroughly

If a company sparks your interest, you’ll make a preliminary request for more detailed information. This deeper dive helps you assess the potential benefits and risks, determining if proceeding with the acquisition makes strategic sense.

6. Negotiating and Signing the Letter of Intent (LOI)

Your initial offer, though often non-binding, sets the stage for the transaction. A Letter of Intent (LOI) may then be signed, signaling your serious interest in the acquisition. This document outlines the key terms and conditions of the proposed deal and paves the way for more detailed negotiations.

7. Conducting Due Diligence

Once the LOI is in place, the acquiring company typically initiates a thorough “due diligence” process. This is a critical step to verify the information provided by the target company and ensure your initial evaluation is accurate. Key areas of review include:

- Commercial Aspects: Examining corporate structure, assets, liabilities, licenses, customer base, intellectual property, and data protection practices.

- Financial Health: Verifying financial statements, assessing accuracy of figures, and calculating the company’s true value.

- Fiscal Compliance: Reviewing tax records and identifying any potential tax liabilities or contingencies.

- Labor Relations: Assessing employee status, contracts, and any potential labor-related issues. For details on labor laws in India, you can consult the Ministry of Labour & Employment.

8. Preparing Acquisition Documentation

The findings from due diligence are crucial for drafting the acquisition agreement and planning post-acquisition integration. Key considerations at this stage include:

- Payment Method: How will the acquisition be funded (cash, shares, or a combination)?

- Assurances: What guarantees or indemnities are provided by the seller?

- Power Division: How will control and decision-making be structured in the combined entity?

- Governance Provisions: Details regarding future management, transfers of ownership, and operational policies.

- Talent Retention: Strategies to ensure valuable employees from the acquired company are retained.

9. Funding the Operation

Based on the evaluations, you’ll have an estimate of the funds required for the acquisition. The timing of the deal often hinges on the availability of these funds. Ideal conditions for an acquiring company to fund an acquisition include:

- Low Debt: A strong balance sheet with minimal existing debt.

- Stable Cash Flow: Sufficient and predictable cash flow to manage new debt obligations.

- Stable or Slow Growth: If your own company is growing rapidly, its cash flow might be better utilized for internal expansion. A stable acquirer can better absorb the financial demands of an acquisition.

- Experienced Management Team: A capable team to integrate and manage the new entity.

- Cost Reduction Potential: Opportunities to streamline operations and reduce expenses in the acquired company.

- Non-Strategic Assets: Identification of assets that can be sold to generate liquidity without impacting core operations.

- Board Alignment: Strong support from your company’s directors.

- Manageable Working Capital: Limited demands for immediate working capital and investment post-acquisition.

10. Closing the Acquisition and Integration

Once all documents are signed and the acquisition is complete, the complex process of integrating the two companies begins. This involves merging different business processes, IT systems, and organizational cultures. Such integrations are typically pre-planned and executed carefully to minimize disruption, as businesses cannot afford prolonged halts in operations. A well-executed integration plan, often developed from the early stages of the acquisition, can lead to a smooth transition and realize the full potential of the combined entity. This can also lead to changes in internal processes and decision-making structures within the merged company.

The Two Sides of Small Company Ownership

For entrepreneurs considering starting a business, it’s vital to weigh the advantages and disadvantages before diving in.

Advantages of Small-Business Ownership:

- Independence: You are your own boss, with complete control over your work hours, salary, and vacation plans. Many entrepreneurs value this autonomy even with the associated risks.

- Financial Potential: Entrepreneurship often offers greater opportunities for financial rewards compared to traditional employment, freeing you from income caps.

- Control: As the owner, you have a hands-on role in every aspect of your company’s operations, from initial concept to final delivery.

- Prestige: Being a business owner often comes with a certain status and recognition, motivating many to pursue their entrepreneurial dreams.

- Building Equity: You create tangible value in your business, which you can retain, sell, or pass on to future generations. It’s common for entrepreneurs to build and sell multiple businesses throughout their careers.

- Opportunity for Impact: Business ownership can provide avenues to contribute positively to society, whether through social initiatives, supporting specific causes, or through innovative solutions that bring about significant change.

Disadvantages of Small-Business Ownership:

- Significant Time Commitment: Especially in the early stages, you’ll likely have a small team, meaning a heavy workload and long hours for you. This can strain personal relationships.

- Inherent Risk: While planning can mitigate some risks, complete elimination is impossible. You face financial risks, potential product liabilities, and internal conflicts that differ from being an employee.

- Uncertainty: Even a thriving business can face unpredictable challenges from external factors like economic downturns, new competitors, or shifts in consumer preferences, leading to constant uncertainty about the future.

- Financial Investment: Starting any business requires capital, often from personal savings or investments. These funds then become tied up in the business, potentially limiting their availability for personal or family needs.

Conclusion

Ultimately, owning a company, whether by starting one or acquiring a controlling interest, comes with its unique set of advantages and disadvantages. It’s crucial for aspiring business owners to thoroughly evaluate these pros and cons, assessing whether the potential rewards justify the inherent risks.

Remember, achieving company ownership doesn’t solely mean starting from scratch. If you strategically acquire enough shares to gain control—often 51% or more—you can effectively become the owner, steering the company’s future direction.